Condo Insurance in and around Carmichael

Get your Carmichael condo insured right here!

Insure your condo with State Farm today

Calling All Condo Unitowners!

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected accident or loss. And you also want to be sure you have liability coverage in case someone gets hurt on your property.

Get your Carmichael condo insured right here!

Insure your condo with State Farm today

Agent Charlotte Russell, At Your Service

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Charlotte Russell is ready to help you prepare for potential mishaps with reliable coverage for all your condo insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If you have problems at home, Charlotte Russell can help you submit your claim. Keep your condo sweet condo with State Farm!

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Call or email agent Charlotte Russell today for more information.

Have More Questions About Condo Unitowners Insurance?

Call Charlotte at (916) 927-0546 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

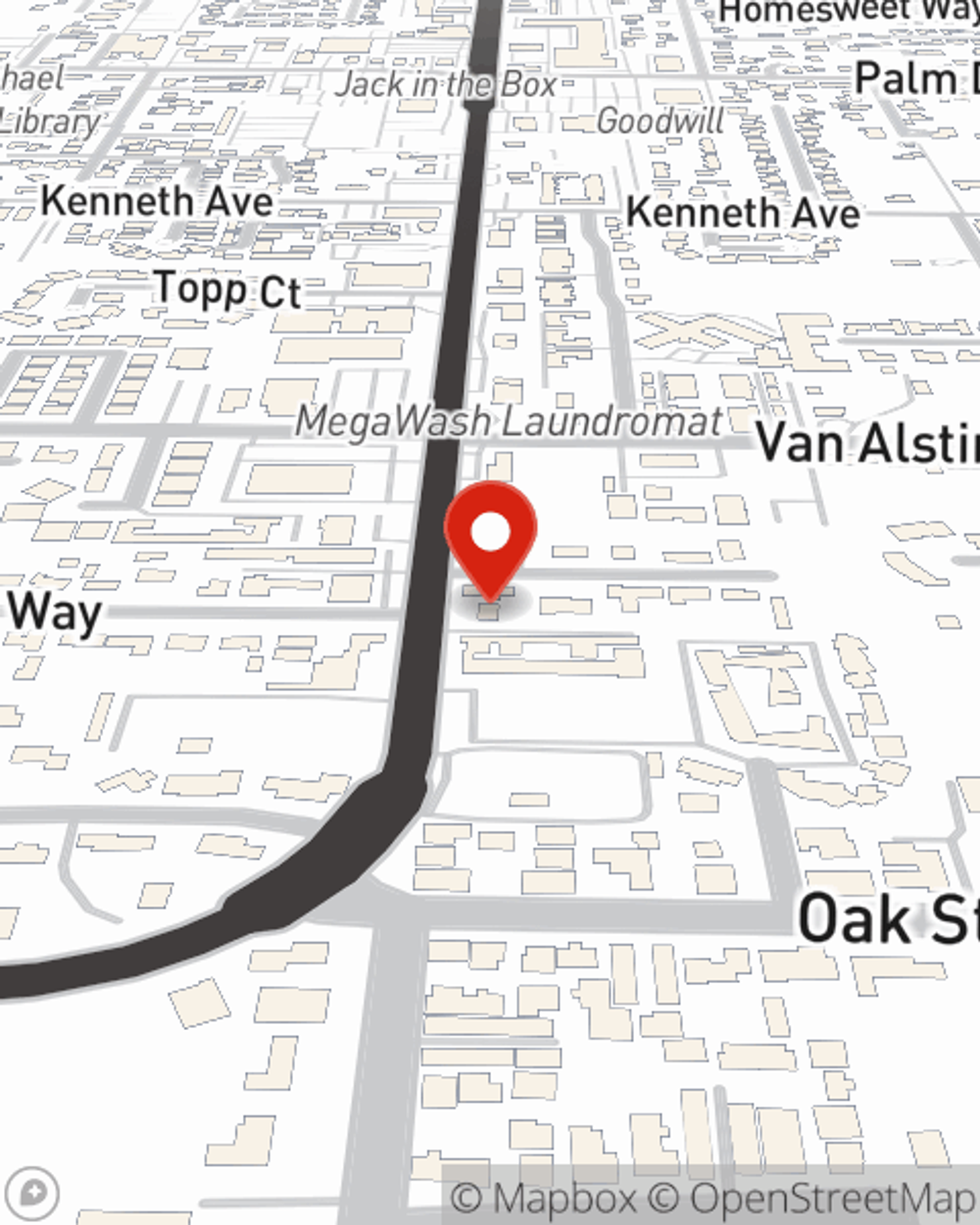

Charlotte Russell

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.